Thanks to Dave Ramsey and his Endorsed Local Providers program for sponsoring this post and inspiring us MAJORLY.

GOSH I DON’T EVEN KNOW WHERE TO START. Okay, this is going to be a long one. I have lots to say.

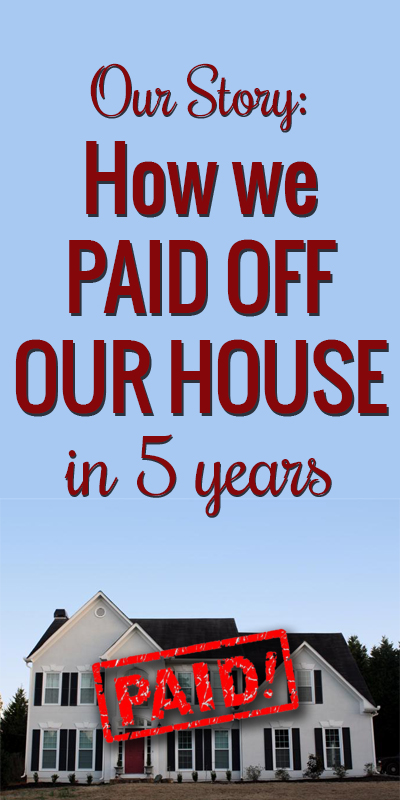

I’ve been thinking about this post and debating whether to write it for a long time. I’m REALLY nervous to tell you all this but I think paying off your mortgage relates pretty well to budget-friendly house talk, am I right? (And when I read Ashley’s post about the same thing a while ago, I was SUPER inspired.) Anyway, I’m nervous so be gentle!

WE PAID OFF OUR HOUSE. Completely. As in, no more mortgage payment for the rest of forever. No debt of any kind, at all.

![]()

I just blacked out for a little bit.

Our initial goal was to pay off the house by my 30th birthday. We missed the goal by 12 hours, but I’ll take it! On October 30, we sent in our last payment to the mortgage company and just looked at each other in silent disbelief. I may have gotten a speck or two of dust in my eye. *ahem*.

This is how we did it.

1. We agreed on our goals.

Even before Andy and I were married, we knew that when it came time to have kids, we would want one of us to stay home with them. In order to do that, we had to be able to live on one income, so we just… started living on one income, from the start. That one income, by the way, was Andy’s teacher’s income. (Read: not much.) We knew we’d eventually want some breathing room in our budget, and with no hope for Andy making substantiallly more money as a teacher, we thought the best way to do that would be to buy – and pay off – a house. (At the time, it seemed like such a distant goal!)

2. We paid cash for everything.

While we were living on Andy’s income, we used mine to save for a down payment for a house, and when we bought that house, we kept living on one income and used all of my paychecks to pay cash for the improvements. All the before-and-after photos on my blog and all the projects were financed with cash, as we went along. If we didn’t have money for something, we waited until we did.

Everything extra we could scrounge went toward the mortgage, and this is what really fueled the DIY fire and pushed us to do our projects on the tiniest of budgets — because we knew our goal: be able to live comfortably on one income so one of us could stay home with the (still-unborn) kids.

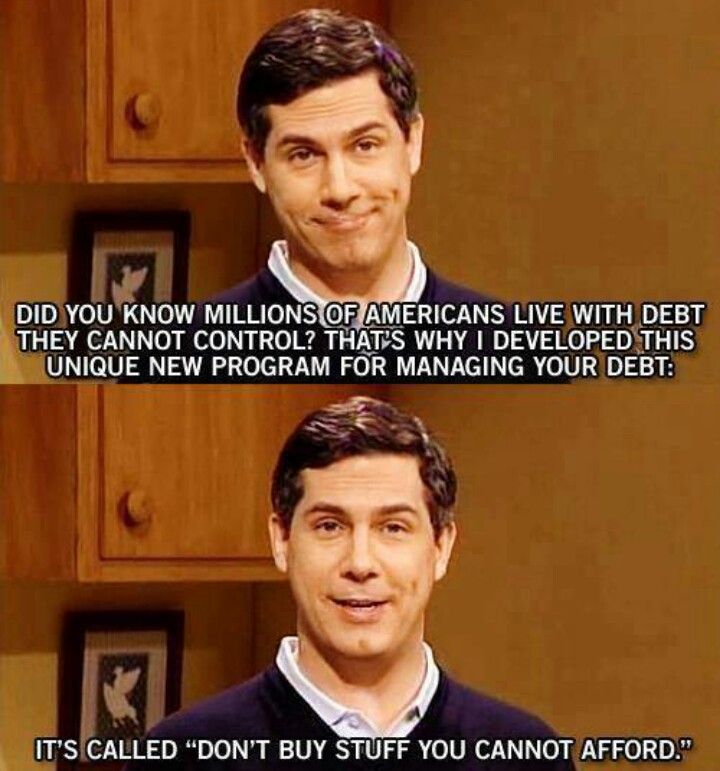

3. We bought less house than we could “afford.”

The bank wanted to loan us more than double what we knew we could comfortably pay. We sat down and made a written budget so we knew exactly what was a reasonable monthly payment for us, and we bought exactly that much house and not a cent more, on a 15-year mortgage so we could pay it off as soon as possible. (This is where having a good real estate agent will come in handy! You definitely want someone who respects your budget and wants to abide by it. In other words: someone who has your best interests at heart. This is an excellent place to find a real estate agent who will work within your means.)

4. We drove crappy cars.

It seemed like all my coworkers and friends were driving shiny new cars, but we were still driving beater 15-year-old cars with LOTS of miles. Now I drive this gateway-drug-to-mom-jeans. It’s ten years old and has almost 150,000 miles. We paid for it with cash we’d saved and, after driving older, grosser cars for years, it totally felt like an upgrade. (Except the whole slippery-slope-to-teddy-bear-wallpaper thing.)

5. We kept a tight written budget.

We wrote down on paper exactly how much we could spend each month on each category of expenses, and we each got a small amount of money to spend on whatever we wanted. (At first it was only $25 a month!) We had exactly $300 for groceries, and at the end of the month if we had spent it all, we had to scrounge in the dark recesses of the pantry and make it work until the next month began. We stretched every dollar, became crazy coupon people, and learned to tell ourselves “no” when we wanted something outside the budget.

Check out this post for some of the creative ways we saved money!

We didn’t make a crapton of money during that time.

During the time when I was working full-time, my salary was decent but nowhere near six figures – pretty close to the national average. When we had our first kid two years into owning the house, I went down to part-time work and cut my pay in half. Then two years later, when we had kid #2, I was laid off and went down to making almost nothing. We’re back to both of us working now – me on the blog and Andy on his new business – and making a moderate income, but we didn’t win the lottery and, to our knowledge, neither of us have any wealthy great-aunts who left us a giant inheritance.

I’m still holding out hope on that one though.

The Joy in the Process

Freedom

I was shocked to find that this whole process of budgeting led to freedom. Before we set a budget, I felt a tiny twinge of guilt whenever I wanted to spend money on clothes or decorations, but once we had a space for that in the budget – we have a small amount of money set aside for decorating each month – and money designated for the purchase of small brass animals, it was practically required that I buy them. Guilt free.

Peace

Having common goals brought Andy and me together in a huge way. There’s nothing like setting goals as a couple, dreaming together, and getting on the same page to make them happen. We would lay awake at night and talk about what life would be like when the house is paid off. We would dream and plan together, and it was SO good for our marriage. Because we made a plan for every dollar we made, we never had to fight about what we were spending. Our priorities had already been decided, and now it was only a matter of following through.

On giving

Our main motivation was long-term freedom: to not be tied down by a mortgage, to make choices that were not constrained by bills.

But I had a few inner struggles along the way. Being out of debt ROCKS and it matters, but I had to keep a constant check on my motivations and my heart. The best prescription I found for that was to keep giving throughout the process, even when it didn’t make sense. Giving for me has been like a cooling salve, a medicine to keep me from becoming a scrooge or losing focus of what is important (and that is loving people).

I once sat on an airplane next to this amazing lawyer who told me the goal of his family is to increase the percentage of their income they give away. He was currently at 50 percent. I LOVED THAT and I never forgot it, so Andy and I made it our goal to increase our giving percentage as well. Being able to give more freely since we paid off our mortgage has been one of the most amazing blessings of my entire life. I want everyone to know what this feels like!

On hope

Y’all, there are two parts of me screaming inside: one part that’s screaming for JOY, and the other part that’s screaming for you to understand my heart on this post. I know for a lot of people, times are tight right now and I’m absolutely terrified that you will think I’m boasting. Hear me on this: I am thankful beyond words. God has blessed us. And we have sacrificed for YEARS to reach this goal. I think you can do it too; I really do. It’s HARD and there’s a lot of sacrifice there, but even setting small goals (like following these baby steps by Dave Ramsey, who is an author and financial speaker) will give you hope, motivation and space to reach for gradually bigger things.

I’m Not Happier Now.

Now that we’re on the other side of things and have had a couple months to let it soak in, one thing that’s really struck me is this: I’m not happier now. I was really, really happy eating peanut butter and jelly sandwiches in a crappy rental house as broke newlyweds. I was content clipping coupons with a newborn baby sleeping nearby. And I’m equally happy now, because being content really is not about how much you have. If you can’t be content having little, you won’t be content having more. It’s really, really true. (This cheesy hallmark card brought to you by the number 9 and the letter F.)

What’s next

I LOVED what setting goals did for our family. In addition to our giving goals, we’re setting other goals for our future.

Raise your hand if you think “investing” is a sexy word.

No?

No one?

Us either. So we’re reaching out to someone who can teach us the right way to invest (for retirement and the kids’ college funds) because that’s just not what we’re good at. We’ve signed up for an Investing Endorsed Local Provider through Dave Ramsey. It’s a person who will walk us through what to do and teach us the mysteries of investing.

It’s really hard to find the right, trustworthy person to help with things like investing, or a good real estate agent or a CPA, so I’m SUPER excited to have this access to local people who have been endorsed by Dave Ramsey (whose principles for getting out of debt helped us a TON) so I definitely recommend starting right here! They’ll send you a name of someone who lives in your area and who will help you learn what you’re doing, not just tell you what to do. (Everything we’ve ever used from the Dave Ramsey site has been amazing. We’ve worked with his ELPs before for insurance and were honestly shocked at the great rates they got us.)

We went on the radio

EEK! Dave Ramsey has a radio show where you can call in and yell “WE’RE DEBT FREEEEE!” and we went to Nashville Tuesday (the day this post went up) to go on his radio show. I WAS SO NERVOUS. One of the camera guys gave me a highlighter pen to fiddle with during the interview and it worked wonders. You can see the magical highlighter pen in the video. 🙂

Be sure to visit to find out how much money your family could be saving, just like we did!

* * *

Whew! I knew I had a lot to say about this but it kind of got out of hand there for a bit, didn’t it? Hope it’s okay to veer (kinda?) off topic. Tell me what’s going on in your world!

This post was sponsored by Dave Ramsey, but all opinions are my own, as always!

Hi, I'm Kelly. Glad you're here! This little blog is where I chronicle our efforts to fix up our beaten-down home on a tiny budget. We're not there yet, but here's a peek at the view along the way...

Hi, I'm Kelly. Glad you're here! This little blog is where I chronicle our efforts to fix up our beaten-down home on a tiny budget. We're not there yet, but here's a peek at the view along the way...

So so so inspiring Kelly! I’m so happy for your guys. That’s amazing!

We aren’t as fortunate as to have our mortgage paid off. Not even close and we are already living in a tiny house. But we do pay anything else with cash. Never financing anything and we have no car payments. A lot of money goes into me seeing my family in Germany every year. If I wouldn’t be doing that our house would probably be paid off already but I just can’t make myself give that up 🙁 It’s so important to me to have my kids see that part of me.

It’s so true that if you can’t be content having little, you won’t be content having more.

Wow! What a great story.. First congratulations to you and Andy not only on”the pay off ” of your mortgage but the” investment” into your marriage. Well Done! Things do not make people happy. Family does. As I always tell my children stuff is not important, things will come and go , family is the important and therefore important. Never live beyond your means the best of times are the struggles. I am so glad you shared your story . Everyone young and old can learn from the both of you~ Many continued blessing to you and Andy and your family

Congratulations!! It’s great that you are sharing your story because most people don’t even think it’s possible to pay of your house. I’m sure you will inspire so many people 🙂

Dear Loan Seeker,

This is to inform you that Genuine loans are now

available at a low interest rate for now and free

from financial stress What is your situation?

You need 100% financing, can not verify income,

can not verify employment, recently self-employed, bankruptcy, credit issues etc.

Please contact us today and get financially equiped.

This is an opportunity that you can not afford to

miss. below is a list of services rendered.

If interested apply now and fill Application Profile

Below for Comprehensive documentation And Verification.

LOAN INFORMATION

Names:

Gender:

Amount Needed:

Purpose For The Loan:

Loan Terms & Duration:

Occupation:

Telephone:

Country:

Monthly Income :

We look forward permitting me be of service. If you are interested in a loan, you are very free to contact

us for further information about:

contact customer service department via email:

(Bayfordloanfirm@yahoo.com)

Regards

Mr bay

This article is very specific for two employed couples. I am single trying to pay off my mortgage in 5 years. I have $52,150. more to go. I don’t make a lot of money because my education is only an Associates degree, not a masters that I wanted to get. My then husband said whenever I approached him about me finishing college said: “Money’s kind of tight right now” ……just what you said in your article about buying something. Well, I wanted to buy an education, not a table cloth, or a new sweater.

So here I am trying to support myself, pay utilities, no credit card debt, getting that mortgage down to zero. I went to a realtor to find out what I qualified for BEFORE I went house hunting. I was smart to buy less then what I was approved for.

Anyway……..your posting is very specific for families. Good for you…..not so for me. I’ll keep plugging away.

I am so happy for you getting rid of that douchebag who didn’t feel that finishing college was important and an investment! And you don’t “only” have an Associates degree – you have an associates degree. And you are smarter than many people who simply buy a house they can “afford” without thought of the future. Good for you! And thank you – it isn’t everyday you hear a single women who by her own accounts doesn’t make much money making the plan to pay off her home! And I bet that Master’s degree will be paid for in cash!

But…she’s not single…

Yes she is. She said her “then” husband and, “So here I am trying to support myself”. She is single now.

This is where a good bit of perspective comes in. In 2014, my husband made $54,000 take-home cash. I made a little over $3,000 with a small business I started. We have a two-year-old son and just bought a house at the end of 2014. Both my husband and I have Bachelors and incurred a lot of debt getting them. So, to me, $52K on an Associates degree and being single would mean I could seriously live it up!

The 52k she was talking about was the rest of her mortgage that she had to pay on

That’s what I thought as I read it, what I wouldn’t give to have another income in my household. As a single mother, with only an associates – that I’ve been able to parlay into a bachelors level job – I’m also in the market to finally make my purchase, with just three years on my solid job. The rest of my employment history built my makeshift college degree (worked for free = college level experience/exposure) but hey I’ve got very little student loan debt – at the end though debt free and living within your means by whatever your method is success – at least in my book

I was single and working 30 hours a week as a waitress and I paid off my house in less than 3 years…it’s not that hard really if you focus and don’t let other people pull you in every direction, a person has to learn to say no to people and their parties, and other invites or at least keep it in control. I feel like you don’t believe in yourself. My original goal was 7 years to pay off my $77,000 mortgage but then a year into it I changed it to 5, I actually paid it off in 2.5 and it wasn’t that hard…no number crunching just passion to pay it off! YOU too can totally do it! 🙂

Hello, I just want to say that being a single parent was the best decision I ever made! I was 35 yr old with two children (14 and 12) and NO child support. I built a house (I gave up all to my husband except this building lot) on my own without a general contractor….sold after the kids were out of high school for a $100,000 profit. Bought a old barn and turned it into a storage business and built my house into it too. I was disabled at age 50…… Had to have a income,therefore the barn house/storage business came to lite. My son and another carpenter built for me (yes ,I paid them,however, very proud of my son for stepping up). Sold out with a $250,000 profit and am now retired and living debt free ……no credit card debt, paid cash for house and car , at the age of 62. When you do not have a willing partner , it is best to strike out on your own. I never went to collage …. You have a advantage their…. You are showing your children they can do anything, have anything they want…. If they are willing to work for it. What really helped me was not being bitter….at first I had to work on it , eventually I saw beyond the internal rage at what had been done to me and my heart healed….my life became easier and my kids became happier. Believe in yourself you can do more then you think..God Bless and good luck. LLB

I say in this economy, roommates are great. For one person to live in a house alone is overspending. Here’s where boyfriends can help. Get one and have him help with the mortgage and heavy lifting.

I’m a woman who paid off her house and did some big time renovation for tenants to live in. I paid off my house in 8 years. It would have been a lot less time if I wasn’t married to someone who loved to spend but earned almost nothing and didn’t like to strip wallpaper or paint.

I’ve noticed a lot of single women who own houses end up marrying they guy who can help them fix things in a house. After all, things need fixing and sometimes on an emergency basis. It’s very expensive and if you don’t know about plumbing, you can end up paying a lot, i.e. getting ripped off.

It’s wonderful if you have parents or brothers around to be sure this doesn’t happen but as for me, I had no one. I did have youtube however and when something needed to be fixed, I watched videos.

A good way to start is to increase payment frquency interest is calculated using time multiplied by rate

So.. this works for lots of other debt to. So if you pay monthly change to weekly it will shave years off your mortgage. Never underestimate the compound effect, even if all you have is five dollars put it on your debt. Banks make millions counting pennies and fractions of a penny so don’t ever think your not putting enough on your mortgage.

This also works really well for paying off credit cards or loc, if all you can afford is the minimum payment then divide it up into 2 payments per week lets say. Your not paying extra, but, the interest is calculated on the average daily balance which will go down every month you do it. Eventually your payment will be lowered but I kept making the same pament. This is how I paid my debt when all I had was enough for the minimum payment. Hope this helps

Congratulations! My husband and I paid off our mortgage on our 25th wedding anniversary! That was our gift to each other! It is a wonderful feeling!

Arlene

I know what you mean about priorities, I am paying for most of a vacation this year because that is more important to me than having my home payed off. My dad is 81 and I don’t know how much time he has as he is getting up there in years.

Congratulations!!! You are so weird! 😉 If my little ones allow, I’ll be listening for your debt free scream. Stories like this help to motivate me to get back on it…right now we’re stagnating at step 4. We’ll be having a budget meeting tonight, my husband just doesn’t know it yet!

WOW- i am so inspired by this! i don’t know if it’s viable for us, but we certainly need to be budgeting better.

Just think about the average income these days. If you took one salary for house payments, the place would be paid off in a short time. I think it’s good for kids to see their parents accomplish things and prioritize. They will probably use this experience in their futures.

Why give kids toys, when work can be as fun and productive. They can see their accomplishments in your house. They can contribute and get praise for their work or some money. When they earn their money, they will spend wisely.

That is amazing and wonderful – congratulations!!

Hi,I bought a fixer upper on one income.I was really inspired by your story.I rescue dogs and that is a big expense but not one I am willing to forego.I am going to get on track and do every thing cash.Thank you for the inspiration.The old saying goes If you are not happy with a little you will not be happy with a lot.Thank you and God Bless to you and your family.

Congratulations! And thanks for sharing!! I really enjoy your blog and I too, am a Dave Ramsay fan!! I hope today is awesome… Enjoy it!

So proud….and envious of you! My husband and I have been using Dave Ramsey’s rules since shortly after we were married. We are still a longgg way from paying off the house. I would love it if you could share some of your budgeting wisdom or tips how you made the little budgets work when there was needs for certain items like maternity clothes, baby gear, etc. Ah, I have sooo many questions since this is our goal too! Hope you make this into a “series”!

Ooh I love the idea of making it a series! If you have any other specific questions, please send ’em over. I’d be happy to post more about it but I’m not really sure what kind of stuff to talk about. 🙂

As a mother of ten children, I *might* be able to say something useful to your question. Gently used baby gear, clothes and maternity clothes can be bought at resale stores like “Once Upon a Child” or garage sales, or Craig’s List. You can borrow baby gear from friend’s who don’t currently have a kid at the age of whatever the baby gear is (aim for a friend with a relaxed nature who isn’t going to freak if your kid adds a scratch to their item). Reuse things from one baby to the next (my 2-speed baby swing I got from a garage sale for baby #2 was still in perfect working order for baby #10. Sure there were much cuter ones, smaller ones, one’s with mobiles, lights but it didn’t seem like wise spending to replace it). Your children need less clothes than you think, don’t buy more than you need. And don’t buy hardly anything under 6 month size because pretty much all baby gifts are under 6 month clothes. Wait until after the baby is born and fill in the gaps of what you need.

Having kids is an expensive hobby. It seems you know how to do it economically. I know kids can feel bad in school when they don’t have fashionable clothes. But this can make them more productive as adults. Much better to start at the bottom. Those doctors’ kids have a hard time getting to where their parents are and most never do.

Having kids isn’t a hobby. It’s sacrifice, it’s a lot of things but it’s not a hobby.

I am currently pregnant with my first and have been trying to do things VERY thriftfully. My biggest rec for maternity clothes — size up and go to the Goodwill and any other thrift store you can find! I just bought a bunch of really blousy larger shirts and it has actually worked out great for me! I also got some maternity pants while thrifting for $2-5 each! I completely built my entire maternity wardrobe at a fraction of the price. The best part? I can continue to wear these clothes after the baby is born since I will have a little extra weight. I doubt I would want to wear a bunch of maternity specific clothing after the baby is born, so it’s nice to know I’ll be wearing “normal” clothes. I also highly recommend gently used baby items from garage sales, thrift stores, and Craigslist. Check your local Facebook groups too. I have found some groups where people post things dirt cheap (for example, I got a baby bath + newborn sling for $1, a baby bjorn for $2, and a Fischer Price play mat for $2). There really are good scores to be had!!!

Awesome!! We are working towards paying everything off too.

Kelly, you are such an inspiration! I’m so glad to see you post this. I’ve been struggling with posting about a similar topic because I too worry that it comes across as boastful, but really I just want to inspire others since I know this is a topic many struggle with. We are also in a similar boat where we are paying off our mortgage, and the final goal is to be financially independent so that we are no longer dependent on our jobs. I really want to delve deeper into how we are doing it without over sharing or turning people off, so I just keep writing and re-writing my posts on the topic. So nerve racking. Thank you so much for sharing!

I love listening to his podcasts of his radio program and hearing the success stories. It is so inspiring!! Good job for you and Andy. Congrats girl!

This is very inspiring! We took the FPU course last year and paid off a couple of bills and was ecstatic. Definitely a good feeling but as time went by we didn’t stick with our budget and we still have bills. Our church is doing another FPU starting this month and I told my husband I really wanted to get back on the ball so we can have peace of mind. So so so happy for you and your family! =)

You’re my HERO! The hubs and I just started hunting for our first house and we got the ODDEST LOOK from our loan officer when we said we wanted a 15 year mortgage. Not sure if we can pay off our (yet to be purchased) house in 5 years, but I’m up for the challenge! Thanks for sharing your story. 🙂

That is awesome! Dave Ramsey has been a blessing in our life too – my goal was to be debt free by the time we were married and with his plan, we were! What I think is important is that his plan does not just tell you what to do, it also completely revamps your thoughts about money, credit and budgeting – which I, with my car payment and credit cards needed. I will say that a paid off car does drive better. 😀

BTW, your minivan post was solid gold funny.

Me, me!! I think investing is sexy! And paying off a mortgage! It is one of the most rewarding feelings ever. Congrats to you guys!

That is wonderful! Can’t wait until ours is paid off!

Gosh. This is incredible! I can’t wait to see you and Andy on Dave Ramsey’s Instagram feed!!

Also, God is so good. Yay!

Word. Yes He is!

That is so inspiring. Stories like this sometimes makes me want to move to the east coast where housing is so much more affordable than here in California. Sigh. We are working towards the same goal, but with housing prices out here we have to go about it a slightly different way. I love all your tips on getting there. We follow those too. I am totally with you on the car situation. My last car which I had for more than 10 years actually came with a pair of mommy jeans ha ha 🙂 Congratulations on moving towards your goals and dreams!!

Not boastful at all…totally inspiring!!! It is good to know that normal people can do that! I know we could budget more per month toward our mortgage (which is pretty depressingly hefty as we bought a house with land last year) and we sat down earlier this year to go through all our expenses and see exactly how much we can save/pay off. We are getting rid of a car payment by buying a used car in March and then we will be driving two old beaters. : ) At least for a few years…but that car payment will be a huge amount we can immediately budget towards our mortgage or savings. : ) I have been thinking about this a lot lately…so thanks for pressing publish!!

Great story and such good advice for your readers. The next phase you mention is saving for college and I want to say that I did that very thing…I had an amount set aside for my son and when he was ready to make a choice, I showed him the total saved. I explained that he could go out of state and have this pay for possibly 2 years or stay in state and have his entire 4 years paid…he chose the in state option and has thanked me many times since his 2004 graduation. He is now married and has just purchased his first home and was thankful that he had no tuition to repay. I too was thankful that I put away the money when he was 5 so it had time to grow…my home is paid off as well and now that I’m 60, I can look forward to retirement and some grandkids to enjoy.

What a testimony Nancy!

First, congratulations! That is incredibly exciting. I did Dave’s “Total Money Makeover” right after college and it has really shaped how I save and spend. Second, thank you thank you thank you. My husband’s and my goal is for me to be able to stay home when we have kids, but since I have the higher income (he’s a teacher) and we live in an area with outrageously expensive housing, we’ve wondered if it will be possible. Your post has given me hope that just because my husband’s passion doesn’t result in a huge income, we can still reach our goal.

You can totally do it! I was the one making the most money and we prayed and prayed and prayed about which one of us should stay home with the kids. In the end, God made it really clear. First, He gave me a job that I could do from home with the baby, then I got laid off the exact same day I found out I was pregnant with #2, and we never never EVER could’ve foreseen how He was working things out so they are now better than we ever could’ve dreamed of.

This is the coolest thing ever! I’m so stoked for you and your family! My husband and I took FPU shortly after being married. We’ve since paid off 2 cars, and are working HARD at a student loan. After that, we hope to have our home paid for ASAP. It’s such an inspiration to see other people working this hard too. And I cannot wait to hear your Debt Free SCREAM – I listen everyday at work and they give me goosebumps every time!!!

I love this so much!! I did think it was sad that your hesitation in posting this is the reality that some people are so blinded/delusional about their poor financial choices that this would make people upset. The truth is, these kinds of amazing moments come from YEARS of making good choices — you & your husband decided years ago this was what you wanted & made GOOD decisions to keep you there. If people get upset, they need to start making better decisions so in years to come they can understand & experience these kinds of declarations. But I think it is fantastic & I can not imagine how amazing you must feel. I am continually reminded by the scripture of being faithful with little — God honors & esteems your faithfulness of being wise stewards of His money. You are an inspiration & I’m so so glad you have shared this to inspire others, like myself!!

I agree, Candace! It is especially a problem in this instant gratification society… and is compounded by people not wanting to take responsibility for their own actions (and the consequences of those actions).

Yes, yes, yes! We did this too. We spent all our money buying our first (and forever) home and about $500 on getting married and the honeymoon. The first few years were a scramble to cover the mortgage each month (we were paying 12% in those dark days), refinanced to a 15 year mortage at 10% when the rates dropped and paid it off in nine years. And we started investing. Plan to get rich slow and you won’t make foolish mistakes. Now, after 29 years of marriage, we’re debt free, fully retired and traveling all over the world. And yes, donating to worthy causes has always been a part of the picture.

We did it and others can do it too. You can’t have it all but you can have any one thing if that’s your priority. For us, it was a paid off mortgage and world travel. Someone else may love boats . Or a second home. Figure it out and make goals together. A boat rows a lot faster and goes further when you’re both rowing in the same direction.

I am amazed and soooo Happy for you and Andy!! I know how hard it must have been at times, and that you pushed through and stuck to your plans is something I would never have doubted you could do. And yes, Most definitely God has blessed you all. Congratulations!!! 😀

^5’s for everyone! lol

p.s. Love this blog today, was very uplifting, other’s Blogs this week seem to be about their most saddest and personal heart-breaking times for all the world to see, and that’s just another reason yours is the BEST!!!

This is amazing! The best part for me…”I’m not happier now.” Money doesn’t define happiness and your reasons for wanting to share with all of us are genuine! Congratulations! ~Sonya

Debt is a terrible thing. You are right to feel so relieved about it being gone! We lived off of my (teacher) salary until I went on maternity leave and put most of Rick’s salary toward his student loans. We’re way over-paying still on those, but it’s so worth it to be (hopefully) debt-free sooner than the lender wants us to be. (Interest=ew.)

Kelly, you guys should be so proud!! You’re one in about a gazillion people who can say they’ve done this! You guys did it the right way and stuck to that budget! I’m in Finance and so I’m probably the only person who thinks investing is a sexy word (hah!)

CONGRATS!! that is amazing awesome and inspiring news! we are on the road to being debt free. By the end of this year we will have no more student loans…then just our mortgage to tackle. Congrats again, this is a HUGE deal! and so cool you will be on the dave screaming the debt free thing! i love hearing that!!

I have those exact same brass deer. Hello, Goodwill $3 purchase! Make sure you have good life insurance. That’s my tip for the day. Kiddos need it too, and if you get them a whole life policy make sure it earns you money and that it provides guaranteed coverage for your kiddos (meaning if they get diabetes, cancer, or some other uninsurable disease (God forbid) then they are guaranteed to have a certain amount of coverage when they’re older). I wasn’t really worried about it until I got my cancer scare and couldn’t get coverage for myself. It’s terrifying to think that if you do lose the battle there won’t be any money for your kids prom dress, first car, college, wedding, etc. My husband is an insurance agent and he’s often coming home teary eyed because a client came in with news of a terminal illness and needs to shell out mega bucks for insurance to provide for their family after their gone. Had they had the coverage before it wouldn’t cost 1/4 as much.

Great post, I’m super jealous and started my debt paydown in early December. I felt like a superstar until I ran my credit report…darn those student loans!

I have to say I’m on the opposite side with insurance. By not buying insurance, I was able to save so much. Of course it’s important to assess your risks. If you think your risk is low and you have good car insurance, I’m happy. Most problems are while you are in your car. But of course, if you think your health or life is at risk, I’d go for the life insurance.

I was hit by a reckless driver 2 years ago. He almost killed me. I don’t have anyone I’m responsible for. Most people have kids or dependents. If they do, yes, I agree, get insurance.

Congratulations! I haven’t listened to the Dave Ramsey show in a while, but I will be for sure today!

Congrats on the home! That doesn’t convey how deeply I really feel about your wonderful news…because our 3rd child wasn’t really “ours” until he was three years old (unfortunate events meant we paid every penny ourselves) and it was very unsettling….because we paid off our house in less than 15 years (we’ve been here 29 years)…because we haven’t had a car payment in years…because I know that when my husband was laid off several years ago, the ensuing unemployment/underemployment scenario with which so many are familiar meant that we still live in our house because we own it–and if we had had a mortgage payment, we would have lost the house. Thanks for the reminder that having 1800 sq/ft while raising 10 kids is OKAY!! Half are grown, married, and have their own houses…and half are on their way…and I don’t think any of them hate us because of it.

As a blogger you want to inspire people. If this post didn’t do that I don’t know what would. This was so NOT boasting, it is a perfect example of the power of being practical, focused and determined. That can be applied to decorating projects as well as your budget. Congrats to you and Andy on this major accomplishment, especially at such a young age. You guys rock!

so, so inspiring. I’m working on baby steps now… paying off the debt we already have and not accumulating more (including currently paying cash for my husband’s masters degree, ughhhh). our goal is to own a new-to-us house (sell our current, buy a new) by age 40!

Way to go guys!!! This post inspires me SO SO much! The hubs and I are in the process of sitting down and documenting our debt so we can start crawling out of it. Thank you, thank you for putting a little more spark under the fire.

Congratulations! How exciting for you and your family. My fiance and I are fans of Dave Ramsey and plan to follow his practices once we are married. We have already started talking about goals and budgets and it is actually a very intimate experience, I would highly recommend it to any young couple. I wish I could listen to you on the radio today, good luck!

Congrats Kelly! What an awesome goal for you and your husband to reach together. I think you told your story perfectly. I completely understand how you may feel that some people think you are boasting. I am currently on the Dave Ramsey plan. Have been for almost a year now and am on baby step two. I have a student loan left and will be debt free by the end of May. Talking about your debt free journey can be difficult with friends and family. They can see the reward but they don’t see the hard work and sacrifice that has to happen everyday to get there. I hope to have a paid for house one day, thank you for sharing your story!

Congrats! That is so amazing & inspiring. I am so glad that you decided to post this story! You made a brave decision that I think will inspire many that you may never know of. You may have offended some, although, I doubt it. You made very clear, your heart on the matter. If people choose to be offended rather than inspired, you can’t own that.

I, too, am familiar with Dave Ramsey & his financial principles. It is a great way to look at money & how to live within you means. Alas, it is so much easier said than done. Because we want what we want & somewhere along the way we became a society of instant gratification so not only do we want it but, we want it NOW! I’m so guilty of that! My husband & I have recently re-committed to put Dave’s ideas into action. (Hopefully, this will be our last “re-committment”!) Way to go! You and Andy should be so proud! And what a great way to teach your children about money so they don’t become part of this instant gratification/entitlement mentality.

Thank you for sharing. My husband and I sold our home this summer and were able to purchase our “new” home debt free. We don’t have a nice house (we’re saving up for a remodel) and I drive a 23 year old truck but somehow it still seems like bragging to say that everything is paid for. I really appreciate your willingness to share. You’ve done something tremendous for your family!

Congratulations! I’m inspired. I’ve always been the saver in my marriage. Dave Ramsey brought my husband onto the team too. We bought a tiny house with a small mortgage in a very nice neighborhood where everyone else’s home is worth 2 to 3 times ours. We can’t upgrade too much : ) But we can pay off a mortgage. I know it is possible and your post has given me fuel. Thanks! I live in Nashville. Wave as you drive by!

I totally waved! 🙂 We got out and saw the Adventure Science Center and explored the city today with the kids. We love Nashville!

Whoa–great work–congratulations!! I’m a little suspicious of Dave Ramsey because I feel like he probably doesn’t want me to go to Disney World ;)….but I was just thinking yesterday that we really need to meet with a financial planner at some point–we have some weird quirks in our finances that make it a little hard to figure out how to prioritize things (I mean even aside from my love of Disney World)

Give Dave Ramsey a try! His principles are really simple, and I definitely don’t think he’s against a splurge – but how great does it feel to splurge when you know that you’re spending your money right, have a grip on your debt and you know you have the money?? It’s about knowing what’s coming in and going out and making the BEST choices so you can be FREE with your money 🙂 GL!

You go girl! You and Handy Andy are two smart cookies! Your hard work has paid off and now your children can benefit from it greatly. Kudos!!!

Hi Kelly, Thanks for this post and your inspiration! You often inspire me with your creativity and now with your awesome financial feat! I am a bit 🙂 older than you and got inspired via Ramsey a few months ago and my husband and I just finished FPU. I can’t even imagine where I would be today had I done this years ago. We are still on Step 2 and pushing. Enjoy your paid off home!!

I don’t know why you put that off and were so nervous about it. It is totally inspiring!

wow. Just wow. That is amazing; congratulations!!

Congratulations! We are nowhere near that point in our journey (not to mention currently living in a parsonage) but we will be debt free except for student loans this June, while we have saving significant amounts of money for things along the way! Once we get a few more things saved up for, we will hit those student loans! It’s exciting and seeming like a very far off goal at the same time!

I’m so excited for you guys! That has got to be such a liberating feeling! I love the fact that you said you’re not happier now. I love that you mentioned that you can be happy no matter where you’re at. And I love that you mentioned the brass deer. 🙂 I am interested to know what you guys budgeted in for decorating every month. We’re on a pretty strict budget (to pay off all debt and save for a house) and I need a little support in the ‘pretty things’ department! 🙂

I think you are amazing and a HUGE inspiration. No where in that post did I take it as you boasting. You all sacrificed and it paid off. Congratulations. I don’t even know you all and I’m excited for you.

How inspiring and I love that you shared this! It really is inspiring (I know, I’ve used the word twice already, might use it again) to see someone set goals that so many people have a hard time setting and then actually DOING. Seriously, this is INSPIRING! Congratulations, so happy for you and your family! There is so much freedom in working towards and achieving your goals together like you have.

So, so cool! Good for y’all! We just bought a house and pay a little extra each month, but haven’t committed to the no-debt plan. It’s a constant internal debate because even though having no debt would be awesome, if this isn’t the home we live in for 30 years, and with the history of the housing market, we don’t want to end up “stuck” with cash in the house and none in the bank, instead of the other way around. Plus we’re interested in income properties, so we want to keep cash available to buy some vacation stuff down the line, make money from it (and save money on travel) and then start to pay things down. I know, it’s kind of TMI, and I know that the major Dave Ramsey goal is “DEBT FREE!” but does he ever address ways to leverage debt responsibly to create more income? Anyways, congrats again!!

Congrats on the “status symbol of choice!” You are such an inspiration!

Wow! Your story is really inspirational. We have no credit card debt or car payments, but we do have a mortgage. It would be awesome not to have to pay that every month! Going back to check out some of your links, thanks for sharing! XO

Congratulations! That is so WICKED awesome 🙂

Congratulations! We live the same way and it is great. I loved hearing about the man whose family gives away half of their income. Fantastic! Thank you for telling your inspirational story. May God richly bless you and all your readers.

My husband and I took a Dave Ramsey class at our church and we are 2 payments away from paying off his truck and only 10 payments away on my vehicle (once we snowball his payment into mine)! We have no credit card debt (after paying off thousands of dollars) and only pay cash. I am so inspired by your story and can’t wait to write a post like yours someday. Congratulations – this was SO well deserved!!

Praise God! That is so awesome – and what’s even more awesome is your “I’m not happier now” statement.

Investing is quite sexy. There’s no magic, though; even advisers can’t beat the market in the long run. Get a book like Bogleheads guide to investing and plop your money in some index funds. Voila! You’re there. Even if you hire someone to help you out, I’d be careful with Dave Ramsey’s investing advice. It’s very optimistic, borderline delusional.

Anyway, congratulations on paying off your house!

Holy crap lady, this is SO SO SO WONDERFUL!! I am listening right now, waiting on you to scream! Inspiration is your middle name right now. I love this. I am about 15 years away from a paid off house, but dude… you are totally making me want to buckle down and make it happen for us in the next 4-5 years. Congratulations to you both. So proud of you guys!

Hi Kelly! I read your post first thing this morning and adore you even more now! I SO ADMIRE the choices and sacrifices you have made. I do not think you come across as boasting at all, but you would be justified in boasting, in my opinion. You accomplished paying off your mortgage through incredibly hard work and smart choices. GOOD FOR YOU!

Like you, my husband and I have tried to be smart about paying off our debt and only paying cash for renovations. We even felt strongly about paying cash for our fertility treatments/IVF to get pregnant with our twin girls. Guess what that meant?! We had to wait longer than we wanted to to become parents (5 1/2 years, to be exact). It was a sacrifice, for sure, but I did not want to have anything negative (i.e., debt) associated with having our children. And we lived with the nastiest, run down kitchen you can imagine in our old house until we had the cash to renovate it. Being thrifty is absolutely one of the reasons we are such hard-core DIYers. You have been an inspiration to me for a while, but you have now taken it to a whole new level.

I am not overly familiar with the David Ramsey approach you followed. When we got married, we read David Bach’s “Smart Couples Finish Rich” and have applied those principles, the biggest of which is when you pay off one debt, “pretend” like you don’t have that money and apply it toward something else. We are 35 and our only remaining debt is our house and a portion of my law school loans. Now you have inspired me to really start chipping away at our mortgage!

Like you, I am grateful that I have been able to save money and chip away at debt. I know many, many people would like to do so and are unable to financially. But there are also many families that are in a position to reduce debt that I think will be HUGELY inspired by your post.

Thank you so much for sharing this, Kelly! (Wow…sorry for the long comment).

That’s so awesome Kelly! Congrats! You have totally motivated me!

So inspiring! Just heard your debt free scream on the Dave Ramsey show and had to find your blog and I did! Congrats to you and your family! My family and I are working on baby step #2 and we’re chugging along and hearing stories like yours keeps us motivated. 🙂

Yay for you! That’s a huge accomplishment! We did a similar thing (paid off mortgage in 5 years) but never really told anyone because I didn’t want to boast about it. Way to put it out there! We also bought less than we could afford, didn’t have any other debt, but we never have had a budget. They don’t work for me but I feel like we are doing well financially 😉 so no budget works for us. Loved reading about your journey!

that is great! congrats! I think the biggest thing people don’t understand is that just avoiding credit card debt is huge. you don’t even have to literally pay cash for everything, just don’t spend more money than you can afford to spend. it’s not rocket science! from there you can do things like pay off your mortgage 10 years early, if you’re lucky enough to live in a place where you can actually buy a house that cheap!

CONGRATS!

That is a huge accomplishment, and you should have nothing but pure pride and joy in not only being able to do this, but learning to live within your means and be HAPPY!!! Not many people in this world can say that! This was VERY inspiring…and I have set a few goals myself for this new year, in terms of reducing debt! Thank you for sharing!

Amazing!! I love this!! I really do! And oh how I wish my husband and I had those same goals (well we did I suppose but didn’t implement correctly 😉 ) when we were your age!

Fabulous post Kelly…and congrats to you and your husband on a job well done!

xo

Nancy

Hi Kelly,

Thank you so much for posting this! It is so nice to hear about other people who understand saving and what freedom it gives you. My husband and I did the exact same thing, almost. I wanted to stay at home with my kids, and in order to do that we knew we would have to NOT have a mortgage. So, at ages 22 and 24, we sat down and made a plan. All of our student loans were first priority and once we paid them off, we too lived off of one income and simply saved the other one. In our minds it didn’t even exist. We lived in an extremely cheap apartment for 4 years, paid cash for everything, drove two paid off & crappy cars. Then we bought our first house with a tiny loan, paid that off in a year, and about 6 months after the house was paid for, we had our first child. And we were able to just keep living how we were because we were used to just having one income. The most important thing for us was that I get to stay home with my kids, so that was our motivation. I hope that young couples really think about what is going to be most important to them and let that guide their choices. It did stink when everyone else was buying new homes and new cool cars, but now all my friends are jealous that I get to stay home when they have to send their babies to day care. It was totally worth it to me, especially now. Thank you for sharing, and I hope others can read your post and realize that they can do it too!

LOVED this post!!! I love that your happiness isn’t settled in money or “things.” AND, I LOVE that you get to scream I’M DEBT FREE today!!! !!! YAY for Dave Ramsey!!

I saw today’s show and my ears perked up when you said you were a blogger. I was hoping you would say the blog name, because I wanted to read the post that you talked about. Instead I just googled “January 14, 2014 we’re debt free” and found you. You and your husband were awesome and inspiring! Congratulations. We are on baby step #2 and are looking forward to the day when we can drive down to Nashville to scream “We’re DEBT FREE!”.

Congratulations! That is a wonderful accomplishment! We started Dave Ramsey a few years ago (we used his book Total Money Makeover), and I was amazed at what we were able to pay off. My student loans, which I thought would haunt me all of my days… gone. I always tell people that it doesn’t matter if you think you can do it or not. Just pray about it, and start following the steps. God will make it happen! We’ve been slacking a bit the past year or so, and we really need to get back to being diligent with our budget. Thank you for the encouragement!

I love your story. You guys have made some smart, tough choices and God has truly blessed them! I missed the live show today, but was able to find the recording on Dave’s site. You did great. 🙂 Rocky and I have always lived by most of Dave’s teaching, and the only debt we have is our house. We’re slowly working on it – I know you understand the joys of a teacher’s salary! Thanks for sharing your story, both here and on the show today, you inspire us to keep plugging away! (P.S. I can’t wait to hear your review of Dave’s new book! 🙂 )

Wow! Super congratulations on being debt free. I’m inspired.

I knew it was you! I listen to The Dave Ramsey Show via podcast on my commute from Gwinnett to Buckhead every day (yuck!). When I heard more and more of your story, I had a strange feeling it was going to be you. I couldn’t wait to get home to check the computer…and sure enough! WOO HOO and CONGRATS!

I have been following your blog for a little over a year. I’m not even sure how I found it, but it’s been a joy getting to know you through your posts and your DIYs. I think I was even more compelled to follow along since I live in the Atlanta area. Small world, huh?

Anyway, I just wanted you to know that even though I’m not always commenting, I’m an avid reader, avid fan, and now a SUPER proud of you and your family. My husband and I are on baby step 2, and it’s such an inspiration to see another young family reach the goal. Enjoy living like no one else, you wierdos 🙂

Congratulations–what an incredible accomplishment! That is amazing, I can’t imagine how great your family must be feeling right now.

Love this!! We also paid off our mortgage in about 5 years by doing the “live on one income” thing even though we were both working. Feels amazing to have it done and know we are completely debt free! It’s a nice peace of mind. And now I can fairly easily stay home with our baby and it wasn’t too painful of a drop!

CONGRATS to you!! My husband and I took the Financial Peace University course last year (thanks to winning the Thrifty Decor Chick giveaway) and have been doing cash envelopes, budgets, the whole 9 yards. We just purchased our first home and can’t wait to pay it off- although I feel like it will take much longer. You are an inspiration!! Thank you for relighting the fire for me to get back on track!

Wow. I am so impressed by you. We’re really good about not going into debt for things like house projects or clothes or other things, but I can’t imagine paying our mortgage off a day sooner than 30 years. Maybe because we JUST got it 🙂 But still… Just, wow.

That is just amazing, Kelly! Congrats to you both for your hard work!

xo Heidi

Oh, my gosh! I’m so happy for you guys! We’ve been fans of Dave’s for years. We’ve managed to get through seminary debt free and stay that way for 10 years. I’m hoping we can work on paying off the mortgage. Talk about the Windows of Heaven opening up and pouring out blessings!!!

Kelly!!!! I just watched you guys on the show and I am sosososososo proud of you guys! My husband is also a teacher and we just sat down tonight to reevaluate our debt pay off plan because it does not feel like it’s going quick enough. Seeing you guys on the show made me teary-eyed. We want the same thing for our daughter and it was awesomely encouraging to know you did it on a similar budget. We have been incredibly frustrated lately, and this is just what I needed to hear. CONGRATS!!!

As I was reading this, I was thinking “this sounds exactly like Dave Ramsey’s plan!” We just discovered Dave Ramsey and are two months into our debt payoff plan. We have a long road ahead and need all the motivation we can get. So happy you shared this story! Congrats!

Kelly, that’s AMAZING!! I came into our marriage 3 years ago with no debt, and I’m so happy that we’ve been able to pay off my husband’s student loans and our car! We (eek!) actually own TWO houses, because my husband was smart to buy a duplex as his starter home and rent out the other side. Circumstances came about that we needed to move, but we now rent out both sides of our first house and that will be fully payed off in 3 years! I’m so excited for that day because we can roll that money into our new house (out of state) to pay it off faster. Sometimes it makes me nervous to have so many “assets” but then I realize that it’s been a blessing to our family and to others. Thanks for the reminder that working hard pays off in a big way and that God will be glorified when we remember that our money is HIS! I also needed this reminder to be a bit stricter with myself on my home decor budget. I have been reading so many blogs lately and have started to just swoon after too many things I can’t afford and I am so thankful for what I already HAVE. Thanks lady 🙂

So so so excited for you! I’ve realized that I’m totally susceptible to the blogmagazine cycle so since it’s January I’ve been wanted to cut back spending (not an actual issue since I didn’t spend on holiday stuff), and lose weight (also tricky since I’m pregnant).

Your story is so inspiring, and as someone who gives 10-20% away (and wants to always make more to give more), I’m so happy that you and Andy are on that path!

Jessica

Kudos to you both! Not only are you smart and wise to do this for you and your kiddos, you are also blessed with a GREAT marriage to work in sync towords solid common goals -enjoy and cherish! Great lesson for all married couples- thank you for sharing!

My first comment! But I couldn’t not say how amazing this is!!! We started Dave’s plan 2 months ago and have a student loan that will be paid off with my husbands summer work over two years. And then to attack that mortgage!! I don’t want the shiny new cars! It’s nice to allow a few things each month! Thank God for Goodwill 😉

Anyway, congrats and you are my inspiration!!

Awesome job guys!! What an inspiration! We are almost there for everything but the house debt, but given our area, it is okay and we are fine with it. Enjoy it and continue to be an inspiration.

CONGRATS TO YOU! The hubs has been trying to get me to read Ramseys book… and I think you actually motivated me to pick it up! I love reading a success story! Good luck to you in your debt free future!

OK, I *loved* your blog the moment I happened upon it. I spent two weeks reading *every single post* and then I forced myself to stop. Like as if I was sane.

I happen to be a huge Dave Ramsey fan, and listening to his podcasts is pretty much my version of an educational soap opera that I listen to while washing the dishes.

I am *so excited* that you are a Dave Ramsey fan, too. Didn’t know how I could love your blog more, but you found a way!

CONGRATULATIONS on being debt free, including the house. You rock!!!

Whoo hoo! Kelly and Andy, I’m thrilled for you guys! Mark hopped on the Dave Ramsey train about mid-way through the year last year and after listening to just a few of his podcasts, I was on board, too! It helped spur us on to pay off my student loans faster, so we’re debt free now, too! (Although we’re renters, so the whole mortgage thing has yet to happen.) But we’re really putting away as much as we can right now so we have a nice chunk of change for when we DO find that home of our dreams to put a down-payment on. We’re content with our clunker cars and working on a budget to follow this year. Anyway, it’s super inspiring to hear a story like yours…and you can bet I’ll be tuning in on Tuesday to hear that debt free scream! (We sometimes joke that some of them are so awkward if they don’t yet with their full voice, so really go for it, guys! Let the vocal chords reverberate!) “Freeeeeeeedom!!!!”

What an amazing and truly inspiring story Kelly. Congratulations on such a huge accomplishment. This is exactly what prompted my want to downsize our home. Financial freedom. Thank you so much for sharing this. Its just another testimonial to what it could feel like reach this goal one day:)

I just completed Dave Ramsey’s The Legacy Journey. You absolutely have to get it. It’s designed exactly for people like you. “We did it; now what?” I promise he will not disappoint. Such a great series. In my opinion, better than FPU.

I heard your debt-free scream on Dave Ramsey’s radio show yesterday and when you said you were a blogger I just knew I had to come find your blog. Congratulations on becoming debt free! Enjoy doing anything you want now that you don’t have any payments. Being able to give is such a fun experience.

Kelly! I love this. This was the motivating post I needed. We’ve taken Dave twice, and have the dream of me having the option to decide if I want to stay home with our kids or not (whenever we have them), and have just begun our debt paying process. If we are able to stick to goal we should have all our commercial debt, including cars paid off this year! My husband is a teacher too, and he drives a beat up minivan we got for free. I loved everything you wrote. So cool. Congrats girl! 😀

AMAZING!! I’m inspired! Could you tell us how you started- what you paid off first, etc.? It seems so daunting when there are so many bills. We don’t have credit card debt but where do we go from there? Canceling cable today!!

Thanks!!!

Thank you so much! I really like Dave Ramsey’s debt pay-off plan. He sets up baby steps, so baby step 1 is to save $1000 emergency fund. Baby step 2 is to pay off all your debts, smallest to largest, except the house. So I would do that. Put them in order of smallest amount to largest, pay as much as you can on the smallest one, and when you pay off the first one, roll over whatever you were paying on that one onto the next one, and keep going until they’re all gone. YOU CAN DO IT! So excited for you guys!

Hi Kelly!

I read your blog often but actually got to hear you on the Dave Ramsey show yesterday-YOU ROCK!!! I didn’t even realize it was you at first until I heard you summarizing your story and then confirmed it once I read your blog today! SO proud of you guys for being such an inspiration to everyone! Love your blog, your humor, and your happiness!!!

YAY! I found you! I saw your spot on the Dave Ramsey videocast yesterday and I was yelling at Dave, “Ask her the name of her blog! Ask her the name of her blog!” Arrgh! It took a good deal of googling and searching, but I found you. Congrats on paying off your mortgage. Don’t feel sheepish or embarrassed about letting others know you paid off your mortgage. I wish more “weird” folk would share their stories about being debt-free. Most people in our society think that is not even possible. They need to know it IS…even on a modest income.

I love another person’s idea (in comments above) about making this a series…maybe you could call it “Frugal Friday” or something like that. Just share different things you have done to help your family make ends meet while paying off your mortgage. These money-saving tips may seem obvious to you, but believe me, there are a lot of people who have never been taught how to live frugally.

Our family recently relocated cross-country and are currently shopping for a home. We are hoping to find something affordable that we can pay off as quickly as possible. I am looking forward to browsing your blog for inspiration…now that I found it! 🙂

so inspiring! love this! we just finished dave baby step of paying off all debt (note:we do not own a home). while it feels good, it is sometimes overwhelming to continue. this was just the push i needed to keep living like nobody now so we can live and give like nobody later!

A page out of my book dear Kelly. And let me just say one of the truest things ever said is written in your post… “If you can’t be content having little, you won’t be content having more”.

Super inspirational post! I love living debt free. It’s such a weight off our backs. I can’t wait to have our house paid off, it will be the icing on the cake. You are an amazing example. I’m grateful to know you!

Kelly,

Thank you for your story… I have read others and they are so motivating! I have started to so something like this for my family. Im a newly wed and my husband and I both have college debt and we would like to save for a house. I have a plan and I’m trying so hard to stick to it. My husbands job doesn’t give him a chance to save like mine does and we cannot live on one salary at the moment but that’s the goal. Baby steps… and hopefully this will all be achieved before the babies come along. We are waiting so that one day we can give our childen a good home environment. . And not worrying about bills and making ends meet all the time. Thank you again! You have reignited the fire in my motivation!

Oh, Kelly, what a beautiful and heartfelt post! I love it! Your blog is way more than just a good DIY project. It’s your life lived out loving and influencing others for God. There is no greater blessing! Your point about contentment is spot on. When you’re where God wants you it doesn’t matter if you have nothing. That peace transcends all! Doesn’t mean it’s not hard, but those memories shared together are the building blocks of your life.

My oldest is now 25 and married. I have a son in college getting ready to get married at 21. I have two adopted children in 9th grade, and I’ve homeschooled for 20 years. In some ways it has passed in a blink! I started blogging to share our adoption story with all its heartbreak and miracles and have ended up as a DIY blogger in a different season of life. At the heart of it all for me is to encourage moms especially to embrace the life they’ve been given and to be CONTENT with little or much. Thanks for your transparency!

And by the way, I’d love to use Andy but he’s requiring 300k pageviews 🙁 Congrats on his new business as it seems like he’s hit a homerun!

I am really glad I ran into this! My husband and I just bought our second home after trying to sell the first one (which is a trailer) for three years. We were having our fourth child and I don’t think I could have lived in that 1200 square foot home and kept my sanity with a family of six. However now after buying a new car to accommodate the family and the medical bills we acquired with our new addition I have been feeling like we are suffocating in debt. Although my husband and I already both full time and now live very modestly while we try to get out of this debt, this has inspired me to concentrate all extra money solely on our mortgage!

I am so happy and proud for you! We too did Dave Ramsey when we were newly engaged and we’ve been on this same journey ever since. We’re also hoping to be debt free by my 30th birthday!!! 4 years and counting…that’s why we keep selling houses 🙂 So proud of y’all and I totally agree with everything you said…we’re much further back in the process, but it brings us together in unbelievable ways. It feels good to have a plan and be on a journey for our family 🙂 Can’t wait to hear what comes next!!!

You two are such an inspiration! So many great tips for anyone, but I think the bottom line is living below your means and always being able to pay for what you buy. (Sort of two sides to the same coin.) Ryan and I have always been adamant about paying cash for renovations and rental properties. We may not have been able to do everything out of House Beautiful, but it was truly beautiful being able to afford our homes.

I love that you touched on how much home you could afford vs. how much the bank said you could afford. It’s crazy to watch shows like House Hunters where the people go OVER what the bank said they could afford. Just makes me shake my head.

You guys are awesome and so smart. I know you’ll inspire others through this post!

I give you the highest of fives! That is AMAZING. We totally don’t save as much as we could, but we’re working on building up a more substantial nest egg. Thanks for the inspiration!

CONGRATULATIONS!!! No debt? No mortgage? How exciting!!! I’m so happy for you guys!!! 😀

KELLY!!!!! WOOHOO!!!! I was so excited seeing you guys on there. I can’t believe how much Weston has grown since we just saw you in March, but hello- Carys is huge now too. I totally got teary excited for you guys when you got to yell out that you were debt free. What an awesome amazing thing!! You guys rock hard core.

Woohoo! That is amazing! Well done! Thanks for sharing your inspiring story. And randomly, I happen to know a lawyer who has increased his giving by a percent every year and is over 50% now. Hmmm…wonder if it’s the same person you met! 🙂 Congrats!

Thank you thank you thank you for this post! I’m totally lost when it comes to budgeting and staying on track. I’m definitely going to check out David Ramsey. Thanks again for the recommendation :))))

Loved hearing your story! I think it’s amazing that your finances were driven by what you wanted…not wanted materially but what you wanted at a more significant level — to be able to stay home with your kids, to be able to give more, and to be able to be on the same page.

Absolutely incredible Kelly (and Andy)!!! I’m so excited for y’all! What an exhilarating accomplishment and a wonderful example for all of us. It’s so inspiring because it was done without a huge lump sum of money or a drastic change in lifestyle. It was simply your choice and dedication…also a ton of hard work I’m sure!!

Wow! What an amazing achievement Kelly! Congratulations! What a feeling, huh?!? You 2 are role models!!

Wow, wow, wow–congratulations. I just learned of Dave Ramsey last month! Isn’t it funny how that happens. No coincidence here, Im sure. We lost everything but our house when the bottom fell out and my husband lost his job 5 years ago. We are nearly 60 with no retirement funds left because we used it to save our home. This is the first time in years that I have felt hopeful and I thank you from the bottom of my heart. Im so happy for you and your family!

Karen

Praise God! The sacrifice has a sweet reward; hope we are there someday. We’ve been through half a dozen hand-me-down cars and couponed a 3 year stockpile of deodorant, but I would love to pay off my mortgage!!

That is amazing! Congratulations! My favorite part of the post is Andy’s purple car. That’s hilarious! Also I do love that you said you aren’t happier. Sometimes I miss the days of struggling actually – eating ramen noodles. It was simpler and I appreciated things more 😀

We are so Proud of you both! I was really impressed with the comments you made about giving. Most people who start to get money stop giving it away which is a huge mistake. We have been lucky to have Bob giving away money to people who use it to improve themselves and in turn they become Bobs themselves. Bob’s giving has made us financially wealthy but that is nothing compared to the spiritual wealth we share. Bob is still alive and giving (and he has a new jet).

So crazy, My husband I were listening to Dave Ramsey’s radio show and heard you guys. We are also “weird” people who don’t have any debt (besides the house) and pay cash for our cars and everything else. We too have driven horrible ugly cars at one time. 😉 We are working towards the same goal of paying off the mortgage. We thought you guys sounded so fun and it was nice to relate to someone, even total strangers. Anyway, I totally happened upon your blog from Pinterest tonight and realized this story sounded familiar. Congrats to you guys! That is awesome!! Love your pictures of your home as well, it is beautiful. Very much my style. I’m excited to follow along from now on. 🙂

Wow Kelly! I am so inspired. I was listening to the Dave Ramsey podcast, and when you guys came on my ears perked up! We just bought our first house and have dreams of paying it off by the time we are 30, and I also started a blog last year and hope to someday turn into a paying gig (www.allpreciousandpleasant.com). When you said you were a blogger, I quickly did some googling and when I realized it was a blog I already follow, I thought “hey I know those people!”

So excited for you. So inspired. Thank you for sharing!

Thaaaaaaaaaaaank you for sharing this!!!!! My husband and I have always been “ok” with spending, and we have long been listeners and fans of Dave Ramsey…without ever taking his advice too seriously (I mean, c’mon, beans and rice versus eating out?) But a few days ago, we decided “YES, it IS worth it.” We just started working on our budget and are excited about the changes. We are starting the debt snowball now, and part of our motivation is the fact that right now, we can’t afford a stay-at-home parent. Although we don’t have kids (yet), I really hope to be a homemaker one day. Debt-free freedom will help us get there. THANK YOU for sharing!!!

Sooo excited for you! That’s beyond huge!!

Congratulations on such a great accomplishment. I am also a big fan of Dave Ramsey. Someone from our church gave my husband and I the “Total Money Makeover” book as a wedding gift and I read it in about a week – seriously one of the best gifts newlyweds can receive.

Your goal (and the reasons behind it) is exactly what I dreamt to do when we first got married a 1.5 years ago. We are currently working on paying of student loans, which should be all gone this summer. We are currently not doing the 1 income thing, but your post has re-inspired me to do so come summer.

Again, thank you so much for posting this message. I know it’s not easy living like no one else. I feel like I’m in a constant struggle between making the sacrifices for what I want in the long run (doing what you did) and wanting to keep up with the Joneses. Your post reminds me that it CAN be done and it IS worth it. Again, congratulations and enjoy your newfound debt-free freedom!

This is so inspiring. We are living this right now and it’s nice to see someone who has accomplished it! Sacrifice is definitely a word that comes to mind a lot. We have been thrown quite a few curve balls along the way…unexpected surgeries and health issues, but God has always provided for our needs and even sometimes wants in some really surprising ways. Thanks for being so candid about it. I hope we can be mortgage free soon! 4 years to go, but hopefully sooner! xo Kristin

I’m so inspired! Thank you for sharing! My husband and I are a condo now but we want to get into a house (that’s less than what we can afford) and have it paid off quickly. I listen to Dave Ramsey every day at work and I just heard your debt-free scream today!

SO excited for you and your family!

Wow, way to go Kelly and Andy!!!!

I read your post early Tuesday morning and rushed off to tell my husband about it. He was also so excited for you and even tuned us into Dave’s show to see if we could catch you live. We also follow Dave’s plan and are currently debt-free BUT have not yet purchased a house (eek!).

Your post is such a blessing and I hope that we are in the same place when I turn 30. It is so inspiring to hear from two people who have made it happen!! Thank you so much for sharing! You go girl!!!

Congratulations!! You should not feel worried that this is bragging at all. I wish people would talk MORE about money. Why aren’t we allowed to disclose our situations and strategies to each other? One of our friends confessed that they “weren’t able” to save anything while their kids were in day care. (They are “gadget people” and couldn’t fathom not having the latest and greatest everything.) When my husband told them that we were still saving like mad every month with the same basic income and day care expenses, they rethought that strategy and decided to readjust their budget so they could keep saving. If that conversation hadn’t taken place, they might have gone YEARS without saving a dime! I think money talk could be a little healthy competition between people. What percentage of your income do you spend/save/invest, etc.? Everyone’s so afraid of offending other people, but we all really need a kick in the pants, according to the studies on what people have saved for retirement.

THIS! And also, for people who are good at money stuff to share with people who aren’t good at it– so helpful!!

Kelly – I am SO excited for you! My husband just quit his job to come and work with me on my blog too! We are only $50,000 K away from having our house paid off too!!!

Such an inspiration! We’ve been trudging along, using the same techniques as you guys. Unfortunately decent homes can be expensive in our area in California so it’s taking us more time. However it’s so nice to read your success story for motivation when the budget is tight! I’ve already book marked your post for future reading! Great job guys! Looking forward to more posts.

We are currently working our debt snowball and can’t wait to work our way up to paying off our house. I bet it feels amazing. Great work!

This is so wonderful! Made me tear up a little, and is totally motivating. I just turned 30, and its just me and my husband right now. We got married 3 years ago (I was married before and came out of that about $15,000 in debt- worked 2 jobs for 2 years to pay that off before I got remarried) Since then, we have paid off my car, all of our student loans, and any random credit card debt. All we have left is our mortgage and a car. I think we can totally knock those out by the time I’m 35, right?!

Thanks for sharing and congrats!!

Congrats! That is so amazing Kelly! We are working on paying off our student loans now so they can be gone before we start a family. It’s no easy task, that’s for sure!

I bet that was a great feeling to finally have your house paid. Congrats.

AMAZING! When I paid off my car this year, I felt like a big deal, but this is HUGE. I’m knocking away the credit card debt and then will be focusing more on the house. I’ve considered refinancing into a 15 year mortgage, but there’s a move to FL slightly on the horizon, so I’m not so sure that’s the right move. I’ll have to look into what Ramsey might say about that!

Congrats! We’re about 2 years out. Pesky $100,000 in pharmacy school loans didn’t help our cause. (This is why the world has pharmacists. We can’t quit until we pay off our student loans. :P) And I have to keep talking Nate out of new cars. I shared this with him and he actually mentioned the car thing. (Thanks, friend! :))